The Ultimate Guide To Medicare Advantage Agent

The Ultimate Guide To Medicare Advantage Agent

Blog Article

The smart Trick of Medicare Advantage Agent That Nobody is Talking About

Table of Contents4 Easy Facts About Medicare Advantage Agent DescribedMedicare Advantage Agent Fundamentals ExplainedThe smart Trick of Medicare Advantage Agent That Nobody is DiscussingMedicare Advantage Agent Can Be Fun For AnyoneWhat Does Medicare Advantage Agent Do?Things about Medicare Advantage Agent

The quantities vary by strategy. Your health and wellness strategy could pay 80 % of the cost of a surgical treatment or hospital stay.

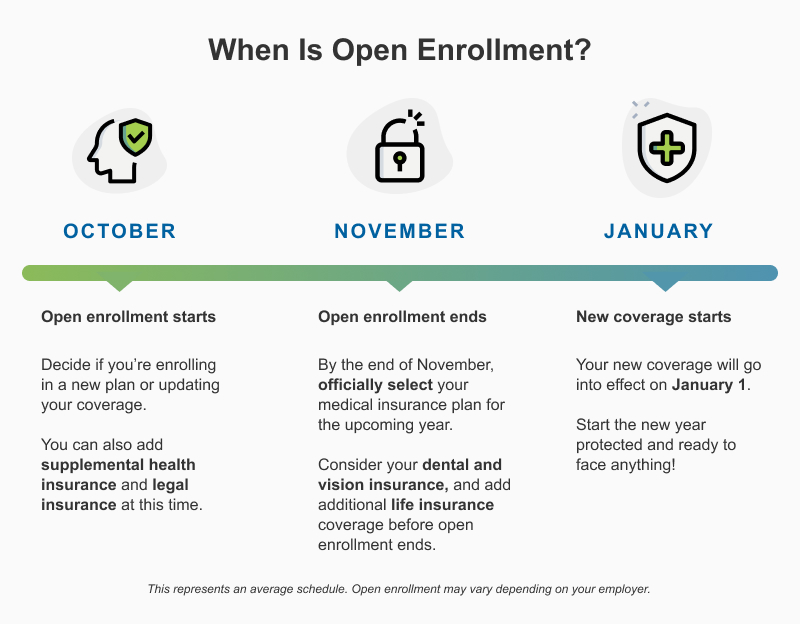

A plan year is the 12-month period from the date your insurance coverage started. As an example, if your insurance coverage began on September 1, your strategy year lasts until August 31. Discover more: Just how to save cash at the doctor Treatment alternatives and expenses There are 4 kinds of major clinical wellness plans in Texas.

The 4 types are: HMO plans. Unique company (EPO) strategies. Preferred copyright (PPO) plans. Point-of-service strategies. All 4 kinds are managed treatment plans. This indicates they agreement with medical professionals and other health treatment service providers to treat their participants at reduced prices. These service providers compose a strategy's network. Taken care of treatment strategies restrict your choice of doctors or encourage you to use physicians in their networks.

Some Known Details About Medicare Advantage Agent

The strategies differ in the degree to which you can utilize doctors outside the network and whether you have to have a physician to supervise your care. You have to utilize companies in the HMO's network. If you do not, you may have to pay the complete cost of your treatment yourself. There are exemptions for emergency situations and if you need treatment that isn't available in the network.

If the anesthesiologist is out of your health insurance plan's network, you will certainly get a shock bill. This is likewise called "balance payment." State and federal regulations safeguard you from surprise clinical expenses. Locate out what bills are covered by shock invoicing regulations on our web page, Exactly how customers are safeguarded from shock medical expenses To find out more concerning obtaining assist with a shock costs, see our page, Just how to obtain assist with a shock medical expense.

You can use this duration to sign up with the strategy if you really did not previously. Plans with higher deductibles, copayments, and coinsurance have lower premiums.

The Best Strategy To Use For Medicare Advantage Agent

Know what each plan covers. If you have medical professionals you want to maintain, make sure they're in the strategy's network.

Make certain your drugs are on the plan's listing of authorized medications. A strategy won't pay for drugs that aren't on its checklist.

There are separate warranty organizations for various lines of insurance. The Texas Life and Medical Insurance Guaranty Association pays insurance claims for wellness insurance. It will pay insurance claims approximately a dollar limit established by legislation. It does not pay insurance claims for HMOs and a few other sorts of plans. If an HMO can't pay its claims, the commissioner of insurance coverage can designate the HMO's participants to an additional HMO in the location.

Your spouse and youngsters also can continue their coverage if you take place Medicare, you and your partner separation, or you pass away. They need to have gotten on your strategy for one year or be younger visit than 1 year old. Their coverage will certainly finish if they obtain various other insurance coverage, do not pay the premiums, or your employer quits offering medical insurance.

An Unbiased View of Medicare Advantage Agent

You should inform your employer in writing that you desire it. If you continue your coverage under COBRA, you need to pay the premiums yourself. Your employer does not need to pay any one of your premiums. Your COBRA coverage will certainly coincide as the coverage you had with your company's plan.

State extension allows you keep your protection site link also if you can not get COBRA. If you aren't eligible for COBRA, you can continue your protection with state continuation for nine months after your work ends (Medicare Advantage Agent). To get state continuation, you have to have had coverage for the three months prior to your work finished

If you have a health strategy via your employer, the employer will certainly have details on your plan. Not all health prepares cover the exact same solutions in the same means.

Not known Details About Medicare Advantage Agent

It will certainly additionally inform you if any kind of solutions have limitations (such as maximum quantity that the health insurance will certainly spend for sturdy clinical tools or physical treatment). And it needs to inform what solutions are not covered in any way (such as acupuncture). Do your research, research study all the choices offered, and examine your insurance plan before making any kind of choices.

It needs to inform you if you need to have the health insurance plan accredit treatment before you see a supplier. It must additionally tell you: If you need to have the plan accredit treatment before you see a supplier What to do in instance of an emergency situation What to do if you are hospitalized Keep in mind, the health and wellness strategy may not pay for your solutions if you do not follow the appropriate procedures.

When you have a clinical treatment or see, you typically pay your health treatment supplier (doctor, healthcare facility, specialist, etc) a co-pay, co-insurance, and/or an insurance deductible to cover your portion of the company's bill. Medicare Advantage Agent. You anticipate your health insurance plan Recommended Reading to pay the remainder of the bill if you are seeing an in-network provider

Medicare Advantage Agent Fundamentals Explained

Nonetheless, there are some instances when you could need to sue yourself. This could happen when you go to an out-of-network provider, when the company does decline your insurance, or when you are traveling. If you require to submit your own health and wellness insurance policy case, call the number on your insurance card, and the customer support agent can educate you just how to submit a claim.

Numerous health insurance plan have a time limit for just how long you have to sue, typically within 90 days of the solution. After you submit the case, the health insurance has a minimal time (it varies per state) to inform you or your provider if the health strategy has actually accepted or denied the case.

For some health and wellness strategies, this medical need decision is made prior to treatment. For various other health strategies, the choice is made when the company obtains a bill from the supplier.

Report this page